Integrity · Pragmatic · Perfect · Fast · Assured - international brand

Sales hotline

Sales hotline

StandardDIN931Grade4.8/6.8/8.8/10.9/12.9MaterialLow carbon steel/medium carbon steel/alloy steelSizeM3-M100; 1/4"-3"Finishblack/zinc plated/hot dip galvanizedMarkAccording to customer's requirementDelivery timeNormally in 30-40 days.QualityTop hi···

High quality materialManufactured from top-class materials such as GCR15, GCR15SIMN and G20GR2NI4A, these materials are widely recognized for their outstanding strength, hardness and corrosion resistance. When operating in high temperature environments, these ···

Stainless steel Duct, abbreviated as SUS Duct, is a ventilation duct made of stainless steel. The duct has two main shapes: round and rectangular. According to different engineering needs, the finished air ducts of various specifications and plates can be cust···

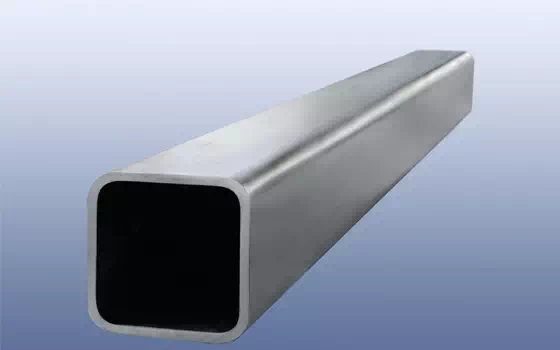

Because the galvanized square pipe is subjected to high-end galvanized treatment on the surface, it can have good weather resistance and corrosion resistance, not only can make the use of strength become higher, but also can avoid the appearance of aging, beca···

Galvanized air duct does not need late maintenance in the future of the equipment, so that it can save a lot of late maintenance costs, and it does not need to worry about the problem of late use; In terms of raw materials, galvanized air duct is made of galva···

Hot rolled steel,cold rolled steel,galvanized steel/55% galvalume steel,GI corrugated sheet/ PPGI corrugated sheet

Provide company news information, and industry news information related information

In August 2015, Taiyuan Iron and Steel was ranked 11th on the list of "Top 500 C···

China Shougang Group, referred to as Shougang Group or Shougang Group, is a tran···

Shandong Iron and Steel Group Co., LTD. (hereinafter referred to as "Shan Steel ···

Shagang Group is a key enterprise group in Jiangsu Province, a national oversize···

The advantages of floor deck slabsThe advantages of floor deck slabs : Lightweight design: Light in weight (about 1/3 of traditional concrete formwork), it is convenient for transportation and o···

Modern Stainless Steel Railing Handrails for Steel Stairs — Engineered for Safety and AestheticsReliable stainless steel railing handrail manufacturer for steel stairs. We provide durable, corrosion-resistant handrail systems suitable for residential, comm···

RAL color pre-coated steel coils lead the new trend of architectural aestheticsDiscover how stainless steel is revolutionizing global industries with corrosion resistance, sustainability, and cutting-edge applications in construction, ener···

In August 2015, Taiyuan Iron and Steel was ranked 11th on the list of "Top 500 C···

China Shougang Group, referred to as Shougang Group or Shougang Group, is a tran···

Shandong Iron and Steel Group Co., LTD. (hereinafter referred to as "Shan Steel ···

Shagang Group is a key enterprise group in Jiangsu Province, a national oversize···

Rizhao Steel Co., Ltd. is located in the beautiful coastal city of Shandong Prov···

The rolling mill of Hebei Jinxi Iron & Steel Group Co., Ltd.

Hebei Iron and Steel Group Co., LTD. (hereinafter referred to as Hebei Iron and ···

Baosteel Group Co., Ltd. is a wholly state-owned company established according t···

Angang Steel Group Limited was established on July 28, 2010, headquartered in An···

Sales hotline:

Scan and consult wechat customer service

Scan and consult wechat customer service