Historical overview

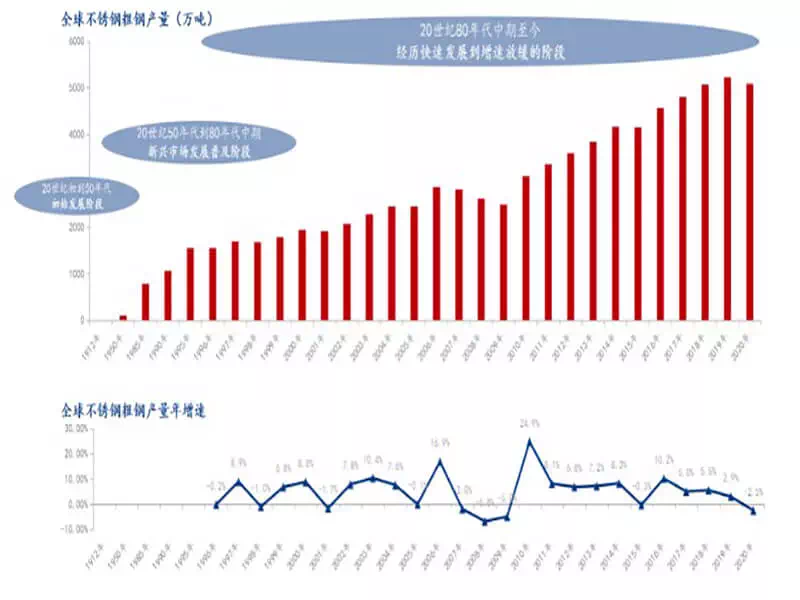

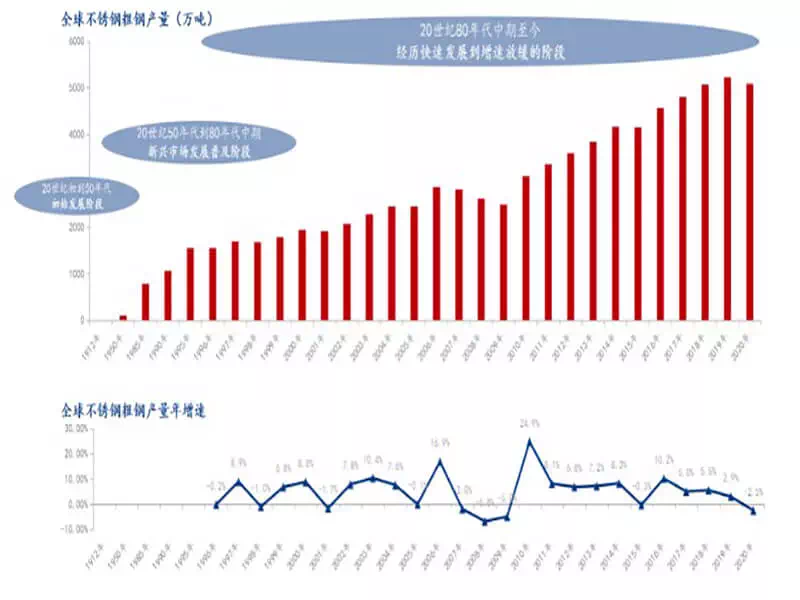

The development of the global stainless steel industry has gone through hundreds of years and has gone through about three stages:

(1)The beginning of the 20th century to the 1950s was the initial stage

Germany, Britain, the United States, and other countries have developed martensitic, ferritic, and austenitic stainless steels almost simultaneously. After about 40 years of development, the global stainless steel output was about 1 million tons in the early 1950s. At this stage, the application of stainless steel is mainly in some areas with special requirements for corrosion resistance and high-temperature resistance.

(2)The 1950s to the mid-1980s are the stage of development

Entering 1950, the American stainless steel industry took the lead in realizing civilian use, and stainless steel production gradually realized accelerated development. After another 40 years of development, by 1990, the global stainless steel production exceeded 10 million tons. During this period, stainless steel smelting technology, continuous casting technology and multi-roll cold rolling mill technology represented by out-of-furnace refining were successfully developed, which promoted the large-scale development of global stainless steel. At this stage, stainless steel began to enter the homes of common people, and the level of civilian use began to gradually expand.

(3)From the mid-1980s to the present, it has experienced a stage of rapid development to a slowdown in growth rate

1990-2000 market expansion period; 2000-2016 accelerated development stage; 2016 to present, growth slowdown stage

Since the 1990s, the development of the stainless steel industry has broken through traditional markets such as Europe, America, and Japan, and has begun to develop into broader emerging markets. The first large-scale main production area in the history of the global stainless steel industry was born in the 1990s, namely the European stainless steel market. After more than ten years of development, by 2002, the global stainless steel output exceeded 20 million tons.

Entering the 21st century, the global stainless steel industry has further accelerated its development. The production and consumption of stainless steel in developing countries continue to grow, especially the rapid economic development of China and other countries in the Asia-Pacific region, as well as the increase in consumption in the civilian sector, which has driven the rapid growth of global stainless steel production. However, during the global financial crisis in 2008, there was a negative growth in stainless steel production for two years. From 2010 to 2016, the global crude steel production growth rate maintained double-digit growth, and China played a leading role.

Since 2017, the growth rate has slowed year by year. In 2019, the global stainless steel crude steel production reached 52.218 million tons, but the annual growth rate slowed to 2.94%. The global spread of the new crown epidemic in 2020 has brought huge challenges to the normal operation of the stainless steel industry. Global stainless steel crude steel production fell to 50.892 million tons, a decrease of 2.5% year on year.

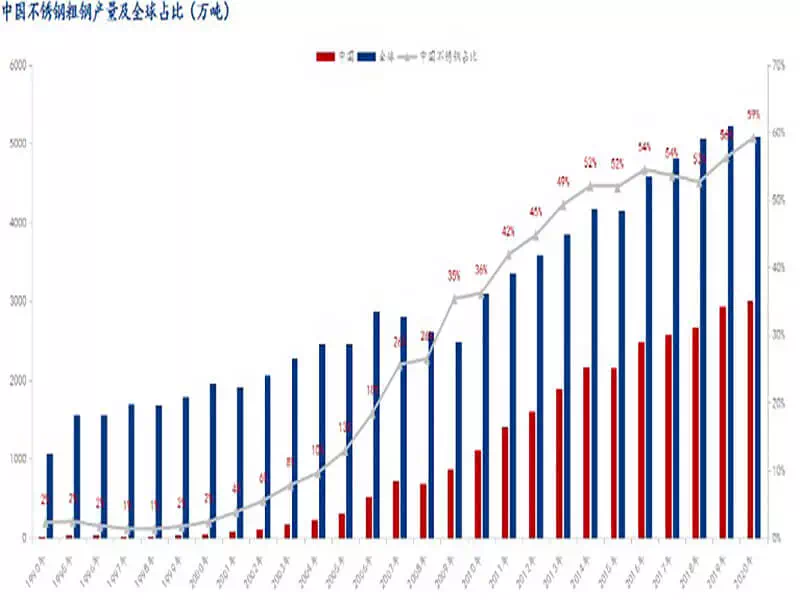

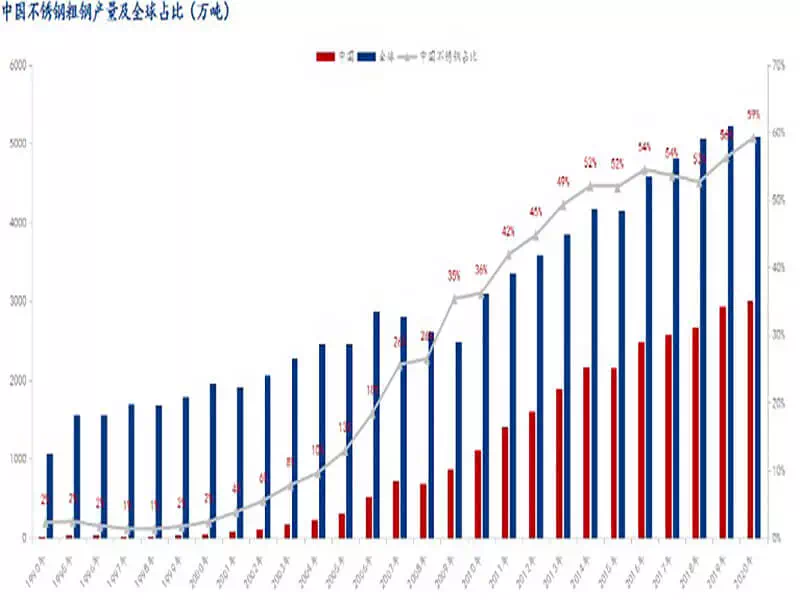

2.The proportion of Chinese stainless steel in global crude steel production is gradually increasing

The development of Chinese stainless steel has roughly gone through four stages:

(1)Before 1980 (1952-1979) was the initial stage

Our country has established some special steel enterprises mainly through learning from the Soviet Union. At this stage, the demand for stainless steel is mainly for cutting-edge use in industry and national defense, and the annual output of stainless steel is very small.

(2)1980-1999 entered a stage of rapid development

The focus of national work has shifted to modernization. By 1999, apparent consumption had increased significantly to 1.53 million tons, and output was only 300,000 tons.

(3)From 2000 to 2007, it entered the stage of technological change

With the rapid development of the national economy and the continuous improvement of people’s living standards, the demand for stainless steel is growing rapidly, and the large-scale use of domestic nickel pig iron has greatly reduced the cost of stainless steel in China. At this stage, the apparent consumption of stainless steel exceeded 5 million tons and reached more than 6.5 million tons in 2007

(4)From 2008 to now, it has entered the stage of adjustment and transformation

In 2008, due to the spread of the financial crisis, the demand for stainless steel at home and abroad weakened, and China’s apparent consumption of stainless steel showed a negative growth year on year. By 2010, the export volume of stainless steel exceeded the import volume for the first time, with a net export volume of 470,000 tons, realizing the transformation of the role of a net importer of stainless steel to a net exporter.

Since 2010, China’s stainless steel crude steel output has maintained relatively stable growth, and its share of global stainless steel output has continued to increase. From the perspective of global production, from 2010 to 2020, the increase in supply will mainly come from China. As of 2020, China’s stainless steel crude steel output accounts for up to 59% of the global output.

At the same time, private steel mills represented by Qingshan and Delong have risen rapidly, and have successively built ferronickel production lines in Indonesia. With a substantial reduction in costs, China has increased its voice in the international market, and both production and consumption have been maintained. Run high.

Analysis of the development status and prospects of the stainless steel industry in 2021

Since April, the price of stainless steel charge has dropped significantly, and the cost of stainless steel has dropped rapidly. In March, although domestic stainless steel profits were average, steel mills were still enthusiastic about production. The output of stainless steel crude steel reached 3.03 million tons, of which the output of 300 series reached 1.38 million tons. Entering April, the profit of stainless steel was significantly restored because of the rapid decline in the price of charge at the raw material end. From the perspective of production scheduling, the start of stainless steel still remains at a high level, with few overhauls, production levels flat from the previous month, and sufficient supply. The agency predicts that as the demand for the stainless steel market picks up in the future, the price of stainless steel is inevitable.

As early as 2017, the Ministry of Housing and Urban-Rural Development specifically approved the “Technical Regulations for Direct Drinking Water Systems for Buildings and Residential Areas” as an industry standard, and stipulated that the pipes should be stainless steel pipes, copper pipes, and other high-quality pipes that meet food-grade requirements. The governments of large and medium cities such as Shenzhen, Foshan, and Changsha have begun to require the use of stainless steel pipes in household water supply systems. The two major cities of the national civilized cities, Shenzhen and Changsha, took the lead in introducing relevant policies for stainless steel drinking water pipes.

At present, stainless steel water pipes account for only 1% of China’s water supply system. It is estimated that within the next ten years, 70% of drinking water pipes will become stainless steel water pipes. As a high-quality water supply material, stainless steel water pipes have long been unanimously affirmed by many health institutions around the world, and stainless steel water pipes have been used for many years in countries with strict water quality requirements such as the United States, Japan, and Germany. With the popularity of stainless steel in residential pipes, the demand for stainless steel water pipes will show explosive growth in the future.

In the 1990s, the world’s major steel companies have undergone mergers and reorganizations to become large multinational companies, and their market share has gradually increased. Correspondingly, the concentration of the stainless steel industry in the global industry is also increasing. Foreign stainless steel production is mainly concentrated in ArcelorMittal (Netherlands/Luxembourg), ThyssenKrupp (Germany), Acerinox (Acerinox), Spain), Avesta Polaris (AvestaPolarit, Sweden), Pohang (South Korea), and other large-scale steel groups, the products are mainly plate, the production capacity of the first three stainless steel companies has reached 2.5 million tons above.

At present, China’s stainless steel production capacity accounts for more than 50% of global production capacity, and the industry has a high degree of industry concentration. As of the end of 2019, China’s stainless steel industry accounted for 81.08%. The overall competition is fierce. And with the concentrated release of new steelmaking capacity in the future, The concentration of China’s stainless steel industry will also further increase.

Leading companies include Tsingshan Group, Taigang Stainless Steel, etc. Tsingshan Holding Group Company is currently the world’s leading stainless steel company, and its output accounts for more than 30% of China’s output. TISCO Stainless is a domestic long-established stainless steel company, leading the industry. Its products are mostly high-end stainless steel products. However, Tsingshan Holdings, relying on its own resource advantages and integrated low-cost smelting methods, has continued to expand in scale and has a tendency to catch up. . In the future, the battle for the leader in the stainless steel industry will most likely start between these two companies.

In the first three quarters of 2020, China’s stainless steel output was approximately 21.94 million tons, a year-on-year decrease of approximately 0.2%. In the third quarter, stainless steel production in mainland China was 8.496 million tons, an increase of approximately 14% year-on-year. It is expected that the production in the fourth quarter will continue to grow year on year. The annual output is expected to be basically the same as in 2019.

At present, China’s stainless steel market has formed two major trade distribution centers, Wuxi and Foshan. The two places account for more than 80% of the country’s total circulation, and a large number of traders and processing companies have gathered. Cold rolled stainless steel coils are generally processed into semi-finished products in Wuxi and Foshan before being shipped to all parts of the country.

The Department of Climate Change Response of the Ministry of Ecology and Environment issued the “Letter on Entrusting the China Iron and Steel Industry Association to Carry out the Work Related to Carbon Emission Trading in the Iron and Steel Industry” to the China Iron and Steel Industry Association. Following the power industry and building materials industry, the steel industry has become the third key industry to be included in the national carbon market. The iron and steel industry, which consumes high energy and involves many key back-end areas, is included in the national carbon market to participate in carbon emission rights trading. This is an important step for both the construction of the carbon market and the clarification of emission reduction routes in the industrial sector

At present, China’s iron and steel industry is mainly based on long processes, with many technological processes, many high-energy-consuming links, and large carbon emissions. Short-process steelmaking, that is, electric arc furnaces, can significantly reduce energy consumption, and if more new energy sources are used, carbon emissions can be further reduced. With the increase in the volume of steel scrap in China, short-process steelmaking will naturally increase.

According to a news from the Ministry of Finance website on July 29, in order to promote the transformation and upgrading and high-quality development of the steel industry, with the approval of the State Council, the State Council’s Tariff Commission issued an announcement that from August 1, 2021, the Export tariffs will be adjusted to 40% and 20% export tariffs. This policy mainly involves some 23 types of steel products including cold-rolled coils, electro-galvanized sheets, tin-plated sheets, silicon electrical steel, and petroleum pipes. The policy adjustments are still aimed at reducing domestic steel exports, ensuring the supply of domestic steel resources, and supporting the country. The implementation of policies to reduce crude steel output, guide the steel industry to reduce total energy consumption, and promote the transformation and upgrading of the steel industry and high-quality development.